do you have to pay taxes on inheritance in tennessee

The top inheritance tax rate is 15 percent no exemption threshold Rhode Island. For example the neighboring state of Kentucky does have an inheritance tax.

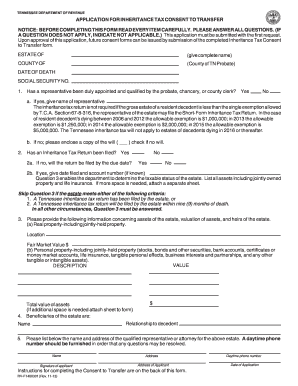

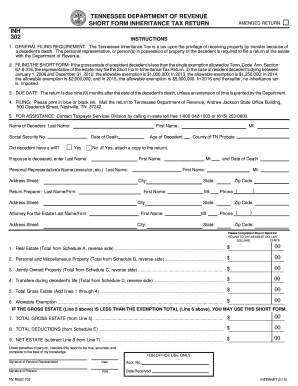

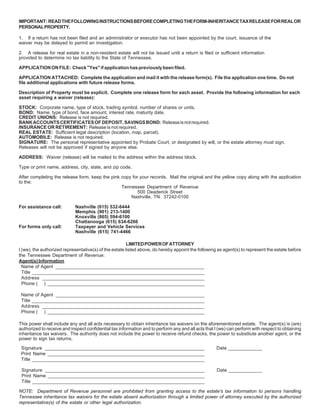

Get And Sign Tn Form Waiver 2013 2022

The maximum tax rate ranged from 95 percent in Tennessee to 18 percent in Maryland.

. Of course state laws are subject to change so if you are receiving an inheritance check with your states tax bureau. If the value of the gross estate is below the exemption allowed for the year of death an inheritance tax return is not required. Tennessee is an inheritance tax and estate tax-free state.

State rules usually include thresholds of value. You would pay an inheritance tax of 11 on 25000 when it passes to you. Mortgage Calculator Rent vs Buy.

The legislature set forth an exemption schedule for the tax with incremental increases for the exemptions until it is completely eliminated in 2016. Therefore the Tennessee income tax rate is 0. Tennessee levies tax on other items outside of income.

Inheritance Tax in Tennessee. The following is a description of how the tax worked for deaths that occurred prior to 2016. For deaths occurring in 2016 or later you do not need to worry about Tennessee inheritance tax at all.

Tennessee does not have an inheritance tax either. How Much Can You Inherit Without Paying Tax All terms that refer to inheritance tax death tax and estate tax mean the same thing. Those who handle your estate following your death though do have some other tax returns to take care of such as.

You must meet all of these qualifications to exclude the gain from the sale of your home from income. However it applies only to the estate physically located and transferred within the state between Tennessee residents. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000.

It is one of 38 states in the country that does not levy a tax on estates. The good news for retirees focused on estate planning. The top estate tax rate is 16 percent exemption threshold.

In 2012 the Tennessee General Assembly chose to phase out the states inheritance tax over a period of several years. What is the inheritance tax rate in Pennsylvania. There is a federal estate tax that.

If you do receive Form 1099 -S you must report the sale of your home on your tax return even if you do not have to pay tax on any gain. No estate tax or inheritance tax. The first rule is simple.

This is how they collect money to pay for municipal items such as first responder services infrastructure roads schools and more. If you owe inheritance taxes the time frame to pay them differs from each state. They are imposed on the people who inherit from you and the tax rate depends on your family relationship.

It means that even if you are a Tennessee resident but have an estate in Kentucky your heirs will be responsible for. There is no estate tax in Tennessee. This is called the federal estate tax exemption any estate under this amount does not pay any federal estate taxes.

The federal government does not have an inheritance tax. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford. No estate tax or inheritance tax.

Tennessee used to impose its own estate tax which it called an inheritance tax This tax ended on December 31 2015. The eight states that levy an inheritance tax comprise Indiana Iowa Kentucky Maryland Nebraska New Jersey Pennsylvania and Tennessee. Inheritances that fall below these exemption amounts arent subject to the tax.

Final individual federal and state income tax returns each due by tax day of the year following the individuals death. The nil-rate band limits what you may inherit with an estate with assets outside of the UK either from the UK or from abroad. The inheritance tax is levied on an estate when a person passes away.

Thats because federal law doesnt charge any inheritance taxes on the heir directly. Do I Pay Uk Tax On Foreign Inheritance. Technically Tennessee residents dont have to pay the inheritance tax.

You must own the property for at least two of the previous five years. It does have however a flat 1 to 2 tax rate that applies to income earned from interest and dividends. There are 33 states that have neither estate taxes nor inheritance taxes.

The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses. No estate tax or inheritance tax. As of 2012 nine states imposed an inheritance tax.

Take a look to see if your state is on the list and also check out some other tax facts for the listed states that might be of interest to you. This applies both to UK and foreign assets which is the assets outside of the UK who do not have an inheritance tax application in the UK. Its the tax due upon the transfer of assets after the death of an owner to an heir or beneficiary.

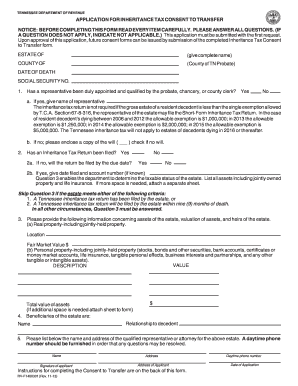

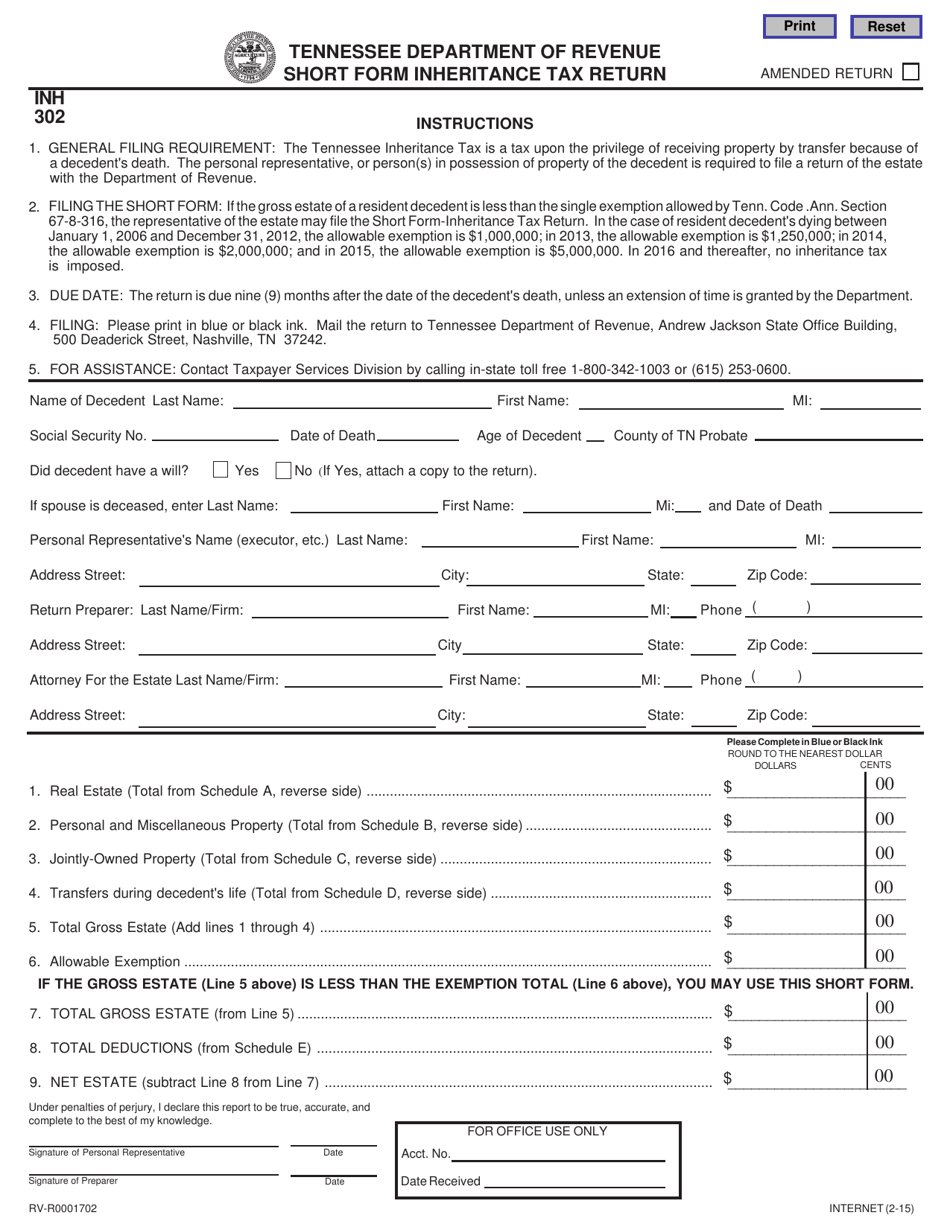

No estate tax or inheritance tax. However if the estate is undergoing probate a short form inheritance tax return INH 302 is required. Each year the exemption amount is adjusted for inflation.

Each state is different and taxes can change at the drop of a hat so its a good idea to check tax laws in your state or better yet talk to a tax pro. Federal Estate Tax. Also estates of nonresidents holding property in Tennessee must file an inheritance tax return INH 301.

If you receive property in an inheritance you wont owe any federal tax. The exemption amount for 2021 is 117 million. Taxes On Plasma Donation.

The long and short of inheritance taxes are that these levies are paid by the living beneficiary who. The inheritance tax is paid out of the estate by the executor. The federal estate tax is only charged when an estate as of 2019 law is over 11400000.

Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. Do you have to pay taxes on inheritance.

Tennessee Inheritance Laws What You Should Know Smartasset

What You Need To Know About Tennessee Will Laws

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Of Tn Inheritance Tax Fill Out And Sign Printable Pdf Template Signnow

How Do State Estate And Inheritance Taxes Work Tax Policy Center

State Estate And Inheritance Taxes Itep

State Estate And Inheritance Taxes Itep

2013 2022 Form Tn Rv F1400301 Fill Online Printable Fillable Blank Pdffiller

State Estate And Inheritance Taxes

A Guide To Tennessee Inheritance And Estate Taxes

A Guide To Tennessee Inheritance And Estate Taxes

Here S Which States Collect Zero Estate Or Inheritance Taxes

Form Rv R0001702 Inh302 Download Fillable Pdf Or Fill Online State Inheritance Tax Return Short Form Tennessee Templateroller

State Estate And Inheritance Taxes Itep

Fill In State Inheritance Tax Return Short Form

Fill In State Inheritance Tax Return Short Form

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die